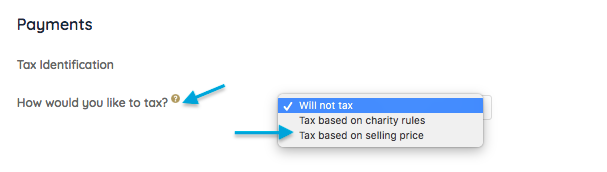

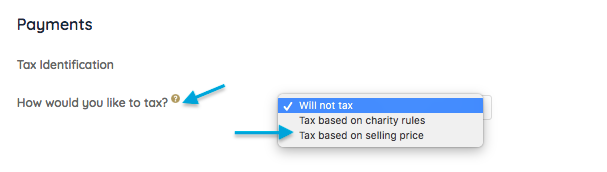

Add a tax or surcharge either due to a state-mandated tax or to pass a fee on to supporters. GiveSmart defaults to 'Will Not Tax'.

Set Tax

- Go to the Admin view.

- Visit the Payments Container from your Dashboard.

- Click the More button ("···").

- Click on Settings.

- Scroll to Payments.

- Select Tax Based on Selling Price from 'How would you like to tax?'.

- Set Tax or Surcharge (%).

- Set Tax or Surcharge label.

- Select Save.

Examples based on a 6.25% Tax or Surcharge

Silent and Live Auction Items

Once the auction is closed and reconciled, the item won is in the winner's cart, along with the 6.25% tax applied based on the won amount (6.25% of the $300 won amount).

Instant Items

Once the Instant Item is purchased, it is in the purchaser's cart. The 6.25% tax is applied, at the time of payment, based on the purchase price (6.25% of $20).

Raffle Items

Once the raffle is purchased, it is in the purchaser's cart. The 6.25% tax is applied, at the time of payment, based on the price of 1 ticket (6.25% of the $5).

For a multi-ticket discount, the tax is calculated by multiplying the number of raffle tickets by the price of 1 ticket ($.31 x 5 tickets).

Vote Items

Once the vote is made, it is in the voter's cart. The 6.25% tax is applied, at the time of payment, based on the dollar amount (6.25% of the $1).

Donate Items

Example of a Custom Donate Item

Once the donation is made, it is in the donor's cart. The 6.25% tax is applied, at the time of payment, based on the donation amount (6.25% of $100).

Example of a Donation from The Click to Donate Button

How to Bypass adding the Tax on to a Click to Donate

Follow the steps below to ensure a tax is not applied to a monetary donation:

- From the Admin Navigation, select Settings and choose Donations from the dropdown.

- From the Donate Page section, toggle Click to Donate from Show to Hide.

Example of a Donate Now Donation

How to Bypass adding the Tax on to a Donate Now

- From the Admin Navigation, select Settings and choose Donations from the dropdown.

- From the Donate Now section, toggle Donate Now Form from Show to Hide.

How to Bypass the Global Tax on an Individual Item

Follow the steps below to ensure a tax is not applied to an individual item:

- From the Admin Navigation, select Auction and choose Manage All Items from the dropdown.

- Click +New Item or edit a current Item Details.

- Click on the drop-down arrow in the Surcharge (%) field in the Item Form.

- Select Set Custom Surcharge for the Item.

- Enter in 0.0.

- Save the new item or updates.